Knowing the accurate building value is important for property registration, stamp duty, and legal verification in Tamil Nadu. The TNREGINET portal provides an online tool that allows users to calculate the building value based on location, structure type, and construction details.

This helps property buyers and owners estimate costs and avoid disputes during registration.

How Building Value Differs from Land Guideline?

- Land — Per sq.m guideline rate (street/survey-based).

- Building — Plinth area rate × area × depreciation + amenities.

- Total Registration Value — Higher of (land + building) or agreed price. Unique: For apartments, building calculator estimates construction; UDS land separate.

Guide to Calculate Building Value

TNREGINET's "Calculate Building Value" module, accessible sans registration, leverages a user-friendly form querying the IGR's 2025-updated valuation matrix (over 5 lakh zonal entries). Outputs a certified report printable for SRO submissions, no fees, results in <30 seconds.

Note: It has public access thus no login is required

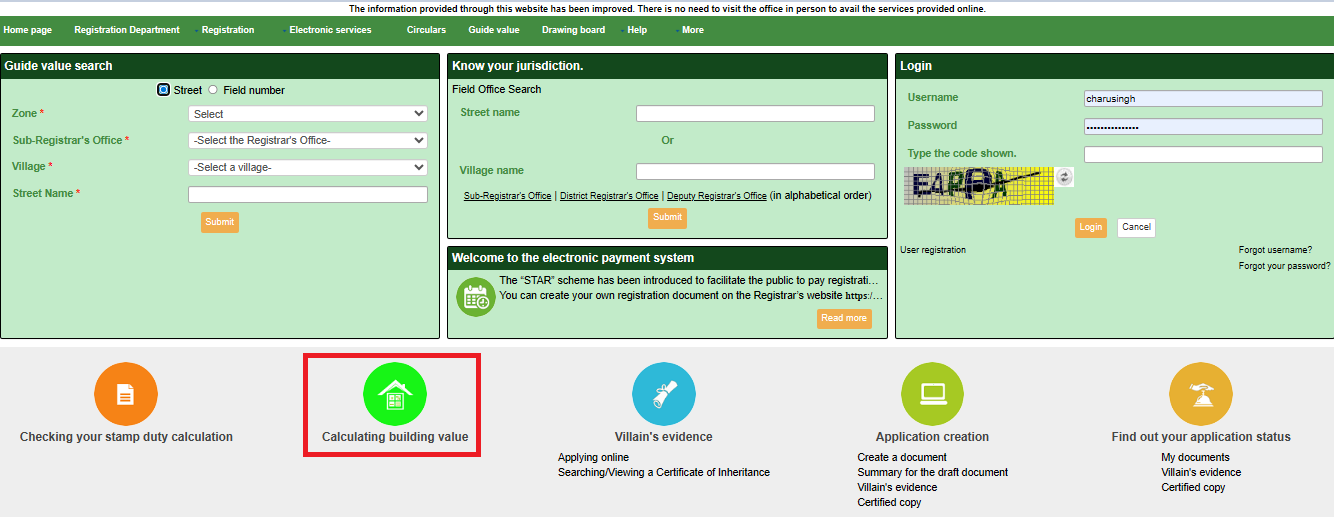

- Portal Access: Visit https://tnreginet.gov.in/portal/ in your browser. Scroll to the footer and click on "CALCULATE BUILDING VALUE", that appears with a green house logo

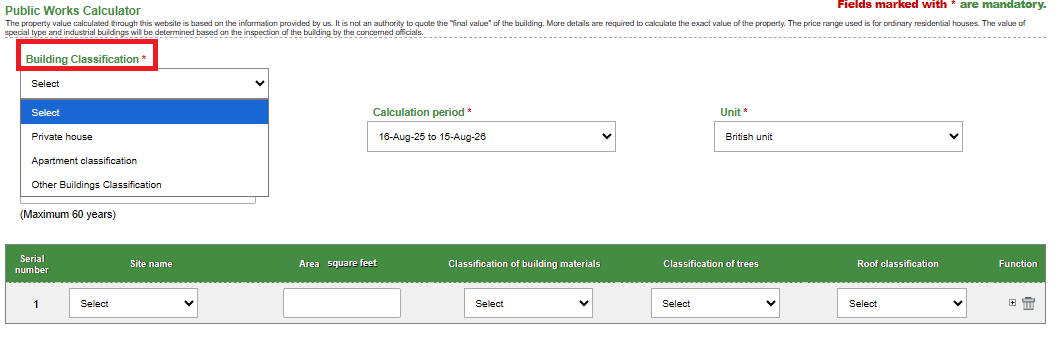

- Input Building Classification: From the first dropdown, select category:

- Residential/ Private (A1: Pucca, A2: Semi-Pucca).

- Commercial/ Apartments (B1: Shops, B2: Offices).

- Others (C: Industrial, D: Institutional).

Example: "Residential - RCC Framed Structure" for a typical 2BHK flat.

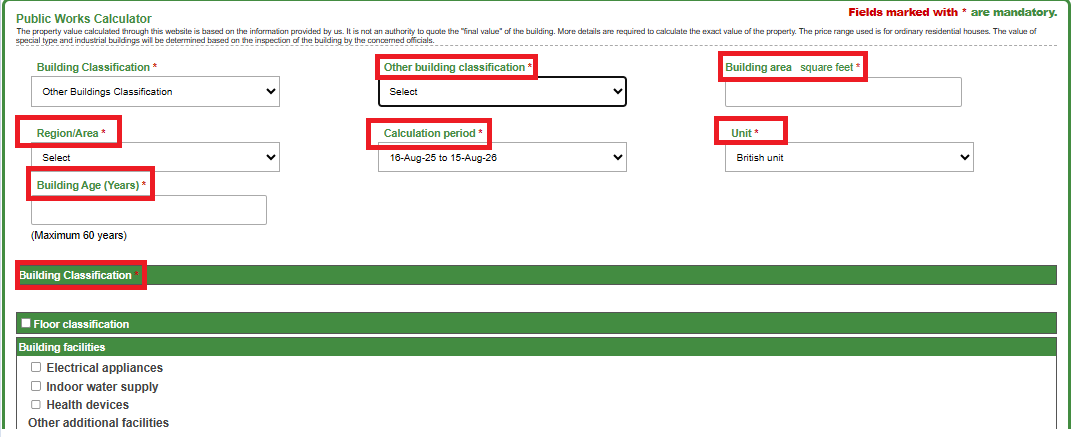

- Specify Building Type and Details:

- Type: Sub-select (e.g., Independent House, Apartment, Factory Shed).

- Age: Numeric entry (e.g., 8 years), auto-applies depreciation table (e.g., 2% p.a. for 0-10 years, straight-line to 60% residual at 30+ years).

- Built-up Area: Enter sq.ft. (e.g., 1200) or sq.m. (toggle unit)—system converts seamlessly.

- Floors: Ground + count (e.g., G+2); premium for stilt parking (+5%).

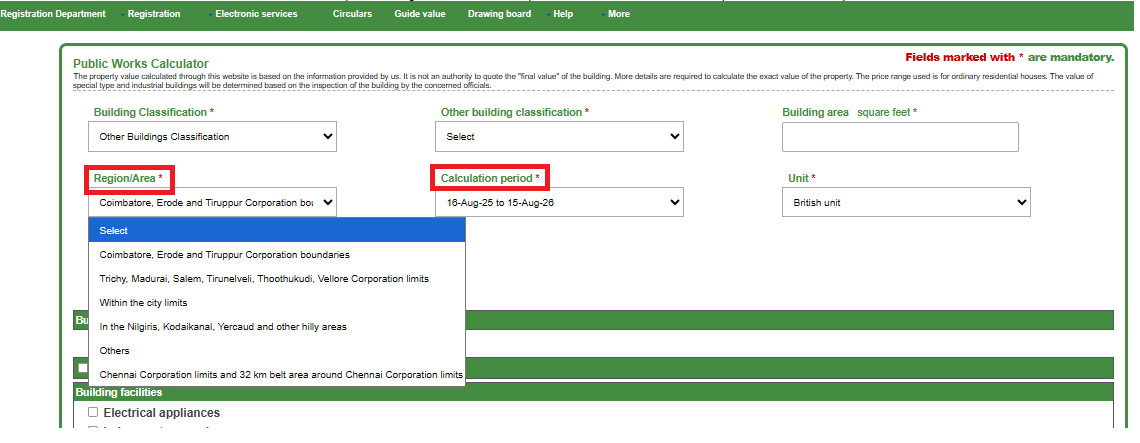

- Enter Zonal and Regional Parameters:

- Zone/Region: Cascading dropdown (e.g., Chennai > Central > T. Nagar), pulls live guideline (₹4,000/sq.ft. base for 2025).

- Street/Ward: Optional text for micro-adjustments (e.g., "Anna Salai" boosts 10% for commercial).

- Calculation Period: Default "Current" (Q4 2025 rates); historical for legacy audits.

- Advanced Options (Optional Enhancements):

- Depreciation Override: Custom rate if certified by valuer (e.g., 3% for seismic retrofits).

- Add-Ons: Lift/AC installations (+₹500/sq.ft.); solar panels (green rebate -2%).

- Multi-Unit: For complexes, input aggregate area—yields per-unit breakdown.

- Validate and Submit: Review summary preview (e.g., "Base: ₹3,800/sq.ft. x 1200 = ₹45.6L; Deprec: -₹4.56L; Net: ₹41.04L"). Hit "Submit", no captcha for this module.

- Review and Export Results:

- Output Dashboard: Table shows breakdown, Base Value, Depreciation %, Add-Ons, Total Building Value (e.g., ₹41,04,000).

- Implications: Auto-computes stamp duty (7% = ₹2,87,280) and registration (1% = ₹41,040).

- Download: PDF report with QR for SRO validation; Excel export for loans. Retain 365 days in browser cache.

| Input | Example | Effect on Value |

|---|---|---|

| Building Type | Residential (RCC) | ₹3,000 – ₹5,000 per sq.ft (base rate) |

| Building Age | 5 years | 10% value reduction |

| Built-up Area | 1500 sq.ft | Value increases based on area |

| Location Zone | Madurai South | 8% higher value |

| Extra Facilities | Lift & Parking | Adds ₹7,50,000 |